1.05 lakh people have invested in this fund

1.05 lakh people have invested

in this fund as of

Total AUM

₹3,076.09 crores as of Mar 31, 2024

Age of Fund

10 years 2 months since Feb 06, 2014

Expense Ratio

1.94% as of Apr 25, 2024

Exit Load

NIL - If the units …Ideal holding period

5 Years+

Holdings

as of Mar 31, 2024HDFC Bank Limited

3.36%

ICICI Bank Limited

1.99%

Bajaj Finance Limited

1.84%

Coal India Limited

1.15%

Century Plyboards (India) Limited

1.14%

Samvardhana Motherson International Limited

1.10%

State Bank of India

1.05%

Large Cap

72.10%

Mid Cap

15.30%

Small Cap

12.50%

Banks

Finance

Auto Components

It - Software

Automobiles

Rolling Returns

Rohit Singhania

Dhaval Gada

Laukik Bagwe

Prescribed asset allocation: 65% - 100% Equity & Equity related instruments including derivatives , 0% - 35% Debt and money market instruments

Top holdings

HDFC Bank Limited

3.36%

ICICI Bank Limited

1.99%

Bajaj Finance Limited

1.84%

Coal India Limited

1.15%

Century Plyboards (India) Limited

1.14%

Allocation by Market Cap

Large Cap

72.10%

Mid Cap

15.30%

Small Cap

12.50%

Top Sectors

Arbitrage (cash Long)

Banks

Finance

Auto Components

It - Software

Top holdings

7.38% GOI 2027

3.45%

7.32% GOI 2030

2.54%

7.06% GOI 2028

2.02%

Bajaj Finance Limited

1.75%

TREPS / Reverse Repo Investments / Corporate Debt Repo

1.73%

Cash & cash equivalents

-0.10%

Instrument break-up

Bonds & NCDs

49.80%

Government Securities (Central/State)

36.00%

Money market instruments

9.10%

TREPS

5.10%

Yield to Maturity

7.60 %

Modified Duration

2.59 Years

Portfolio Macaulay Duration

2.78 Years

Average Maturity

3.32 Years

Portfolio turnover ratio

4.90 last 12 months

Portfolio turnover ratio - Directional Equity

0.38 last 12 months

Standard Deviation

6.20 %

Sharpe Ratio

0.08

Beta

0.76

R-Squared

76.33 %

Performance highlights over last

for

investment

Cumulative returns on

Annual returns

Current value

Historical Returns (As per SEBI format)as of with investment of₹10,000

| This fund | CRISIL Hybrid 50+50 - Moderate… ^ | NIFTY 50 TRI # | ||||

|---|---|---|---|---|---|---|

| CAGR | Current Value | CAGR | Current Value | CAGR | Current Value | |

Income distribution Cum Capital Withdrawal (IDCW) Distributed

| Record Date | IDCW per unit | NAV Before | NAV After |

|---|

| Funds | Annual returns | Current Value | Absolute Growth |

|---|

Date of allotment: Feb 06, 2014.

Period for which fund's performance has been provided is computed based on last day of the month-end preceding the date of advertisement

Different plans shall have a different expense structure. The performance details provided herein are of Regular Plan.

Since inception returns have been calculated from the date of allotment till June 30, 2021

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments

Rolling returns have been calculated based on returns from regular plan growth option.

^ Fund Benchmark # Additional Benchmark

The investment objective of the Scheme is to seek capital appreciation by managing the asset allocation between equity and fixed income securities. The Scheme will dynamically manage the asset allocation between equity and fixed income based on the relative valuation of equity and debt markets.

The Scheme intends to generate long-term capital appreciation by investing in equity and equity related instruments and seeks to generate income through investments in fixed income securities and by using arbitrage and other derivative strategies.

However, there can be no assurance that t ...more

An open ended dynamic asset allocation fund

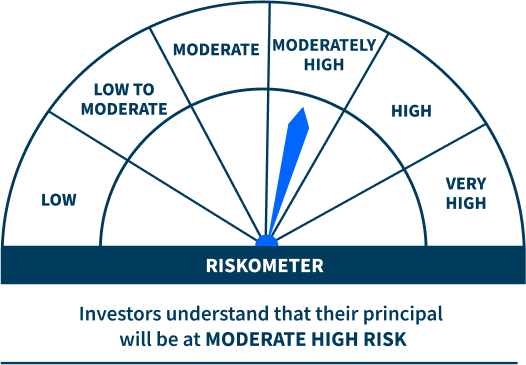

Level of Risk in the fund

Rs. 100 Lumpsum

Rs. 100

SIP– 12 instalments

Rs. 100 Minimum Additional Purchase

1.05 lakh peoplehave invested in this fund as of